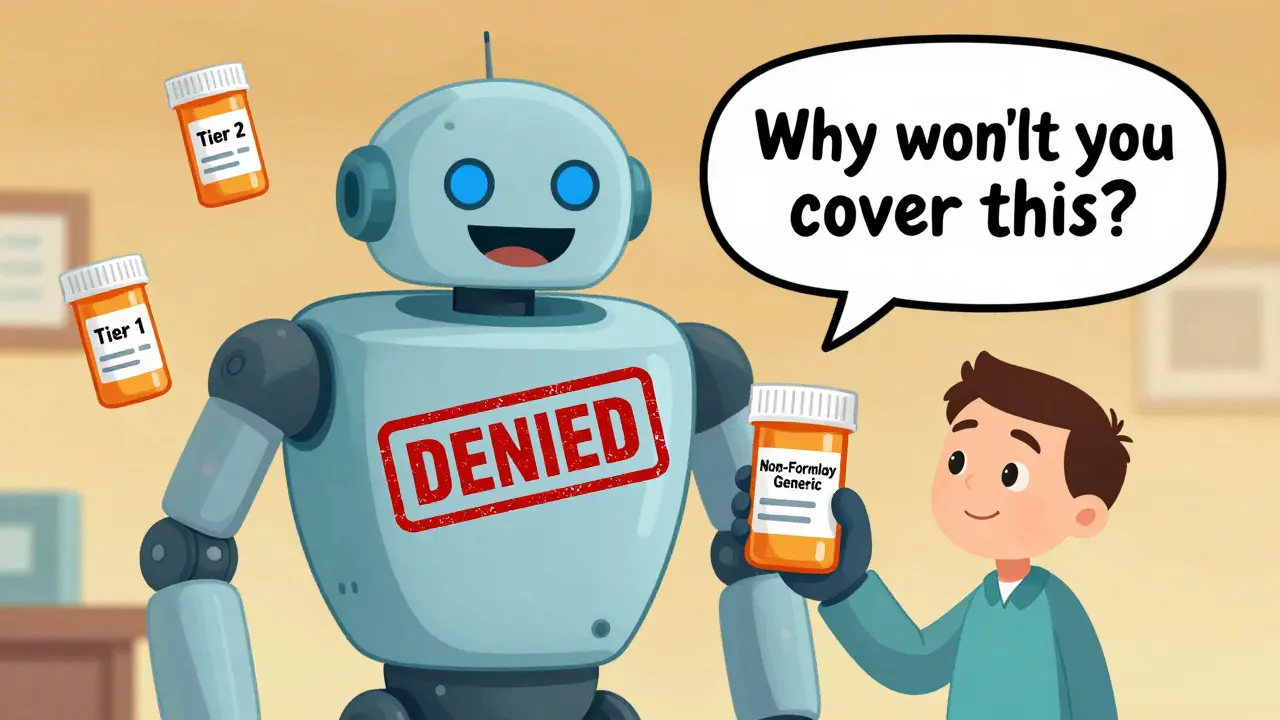

When your doctor prescribes a generic medication and the pharmacy says it’s not covered, it’s not a mistake. It’s a non-formulary generic-a drug that’s FDA-approved, safe, and cheaper than brand names, but your insurance plan doesn’t list it as covered. This isn’t rare. In 2022, over 12% of all generic prescriptions faced some kind of formulary restriction. For people managing chronic conditions like diabetes, Crohn’s disease, or high blood pressure, this can mean paying $400 instead of $15 for a 90-day supply-or going without medication while you fight for coverage.

Why are some generics not covered?

| Reason | Impact |

|---|---|

| Cost-shifting by insurers | Plans push patients toward cheaper alternatives, even if those aren’t the best fit |

| Pharmacy benefit manager (PBM) deals | Insurers get rebates from certain manufacturers, so they favor those drugs |

| Formulary tiering | Generics are split into tiers; only Tier 1 or 2 are covered at low cost |

| Lack of clinical data | Some newer generics aren’t yet reviewed for inclusion, even if they’re identical |

| State or plan-specific rules | Medicare Advantage and commercial plans vary widely in what they cover |

Just because a drug is generic doesn’t mean it’s automatically covered. Insurers build formularies to control costs, and they often choose one or two preferred generics per class-usually the ones they get the biggest rebate on. That means even if your doctor prescribes a generic metformin, if it’s not on the list, you’re stuck paying full price unless you appeal.

What you can do: the exceptions process

Federal law requires every Medicare Part D and most commercial plans to have a formal process to request coverage for non-formulary drugs. This isn’t a loophole-it’s your right. The process is called a coverage determination request, and it’s your first step.

- Get the denial in writing. The pharmacy must give you a written notice explaining why the drug wasn’t covered. Keep this. You’ll need it.

- Ask your doctor to file a coverage determination request. Your provider fills out a form (sometimes online, sometimes paper) explaining why the non-formulary drug is medically necessary. They must state: why other covered drugs won’t work, what side effects you’ve had, and what clinical evidence supports your need.

- Submit the request. Plans must respond within 72 business hours for standard requests. For urgent cases-like a flare-up of Crohn’s or unstable diabetes-they must respond in 24 hours.

According to CMS data, 68.4% of these requests are approved on the first try-especially when the doctor includes specific clinical data. A patient with Type 2 diabetes who shows an HbA1c drop from 9.2 to 6.8 on a specific metformin ER formulation? That’s compelling. A doctor who just writes “this drug works better for me”? That’s often denied.

What if your request is denied?

Denials happen. But they’re not final. You have two levels of appeal.

- Internal appeal. File this within 60 days of the denial. You can submit new evidence-lab results, specialist notes, previous treatment failures. The Crohn’s & Colitis Foundation found that 58% of initial denials are overturned on appeal.

- External review. If the plan denies your appeal, you can ask for an independent third party to review your case. This is mandatory under federal law. For Medicare Part D, this is handled by the Department of Health and Human Services.

Time matters. For urgent cases, you can request an expedited review. If approved, the plan must provide a 72-hour emergency supply while your appeal is processed. But here’s the catch: 37% of plans still refuse to give out these emergency supplies, even though it’s against federal rules. If this happens, call your state’s insurance commissioner’s office. Many states have consumer protection teams that intervene quickly.

Why some appeals fail-and how to fix them

Most denials aren’t about the drug. They’re about the paperwork.

Doctors often skip the details. They write: “Patient needs this drug.” That’s not enough. The best appeals include:

- Specific lab values (e.g., fecal calprotectin for IBD, HbA1c for diabetes)

- History of failed alternatives with dates and side effects

- Documentation of prior hospitalizations or ER visits due to switching drugs

- Letters from specialists confirming the need

Dr. Jane Sarasohn-Kahn, a healthcare economist, says: “The most successful requests don’t just say ‘this drug works.’ They show why the alternatives failed.” A 2023 AMA survey found physicians spend over 13 hours a week just handling these requests. That’s why many miss the critical details.

Costs and hidden traps

Even if your exception is approved, you’re not out of the woods. Here’s what insurers can still do:

- They can’t lower your tier. If your drug gets approved as an exception, you still pay the highest cost-sharing tier-sometimes 3.7 times more than a formulary alternative.

- They can still require prior authorization every refill. You might get approved for one prescription, but each refill needs a new request.

- Some plans use specialty pharmacies. Even generic drugs like bioidentical hormones or certain GI meds are now funneled through specialty pharmacies that charge higher fees and require extra steps.

GoodRx data shows patients pay an average of $287 more per month for non-formulary generics. That’s why 38% of people skip doses or cut pills in half to make them last. That’s dangerous-and preventable.

What’s changing in 2025?

The system is slowly improving. In October 2023, CMS rolled out standardized clinical criteria for common conditions like diabetes, epilepsy, and hypertension. This means doctors now have clear guidelines on what data to include-making approvals faster and more consistent.

Starting in 2024, Medicare Part D must automatically approve exceptions for insulin and naloxone. That’s huge. These are life-saving drugs, and no one should be denied access because of paperwork.

By 2025, CMS plans to integrate the exception process directly into electronic health records. That means your doctor can submit the request with one click, pulling in your lab results and history automatically. This could cut processing time by 40%.

What you can do right now

Don’t wait for a denial. If you’re on a generic medication:

- Check your plan’s formulary online. Look up the exact brand and generic name.

- If it’s not listed, ask your doctor to file a coverage determination request before you fill the prescription.

- Keep a copy of your medication history, including doses, side effects, and why other drugs didn’t work.

- Know your rights: You can request an expedited review if your condition is unstable.

- Use GoodRx or SingleCare to compare cash prices. Sometimes paying out-of-pocket is cheaper than waiting for approval.

And if you’re denied? Don’t give up. The system is designed to be hard-but it’s also designed to be fixable. You have rights. You have options. And you’re not alone.

What if my doctor won’t file an appeal?

Many doctors are overwhelmed by prior authorization paperwork. If your provider refuses, ask to speak with their office manager or medical assistant-they often handle these requests. You can also call your insurance plan directly and ask for a coverage determination form to send to your doctor. Some patient advocacy groups, like the Crohn’s & Colitis Foundation or Patients Rising, offer pre-filled templates to make it easier for providers.

Can I switch to a different generic of the same drug?

Sometimes. But not always. Generic drugs are chemically identical, but they can have different fillers, coatings, or release mechanisms. For people with Crohn’s, epilepsy, or autoimmune conditions, even small differences can cause side effects or reduced effectiveness. If you’ve had a bad reaction to a different generic, document that. That’s your strongest argument for why the non-formulary version is necessary.

Does Medicaid cover non-formulary generics differently?

Yes. Medicaid programs are state-run and generally have broader coverage than Medicare or commercial plans. Most states cover all FDA-approved generics without requiring exceptions. But rules vary. Check your state’s Medicaid formulary online or call your caseworker. If you’re eligible for both Medicare and Medicaid (dual eligible), Medicaid may pay the difference if Medicare denies coverage.

How long does the entire appeals process take?

Standard requests take 72 hours for a decision, then up to 30 days for an internal appeal. External review can take another 30 to 60 days. But if you request an expedited review for urgent care, you can get approval in as little as 24 hours. Always ask for it if your condition is worsening.

Can I get financial help to pay for non-formulary drugs?

Yes. Many drug manufacturers offer patient assistance programs for people who can’t afford their meds-even if the drug isn’t on formulary. Organizations like NeedyMeds and the Patient Access Network Foundation (PAN) provide grants for out-of-pocket costs. You can also check with local pharmacies or community health centers for free or low-cost programs. Don’t assume you have to pay full price.

Final thoughts

Non-formulary generics aren’t a glitch-they’re a feature of a broken system. But that system has rules. And those rules give you power. You don’t have to accept a denial. You don’t have to pay $400 for a pill that should cost $15. You have the right to appeal. You have the right to documentation. And you have the right to be heard.

The system works best when patients and providers work together. If you’re struggling, reach out. There are resources. There are advocates. And there’s a path forward-even when the pharmacy says no.

Health and Wellness

Health and Wellness